Jean Bovin – Head of BlackRock Investment Institute, together with Wei Li – Global Chief Investment Strategist, Alex Brazier – Deputy Head, and Nicholas Fawcett – Macro Research all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

No cuts this year: Inflation has proven sticky, even as growth weakens. Markets are realizing that policy rates are set to stay higher for longer. We like quality in stocks and bonds.

Market backdrop: Tech stocks surged further last week even as debt ceiling talks spurred bouts of volatility. Long-term bond yields climbed on still hot U.S. inflation in April.

Week ahead: U.S. jobs data this week should show a tight labor market is keeping wage pressures elevated. We think that keeps inflation sticky and above policy targets.

We’ve been saying since the end of 2022 that rate cuts this year would be unlikely as inflation sticks around. Markets are waking up to our view as a look under the hood reveals signs of weaker growth in major economies and market weakness due to rate hikes. Debt ceiling talks and the U.S. Treasury potentially being unable to pay its bills by early June have added to recent market volatility. We like quality in portfolios. We upgrade UK gilts to neutral as yields price in more rate hikes.

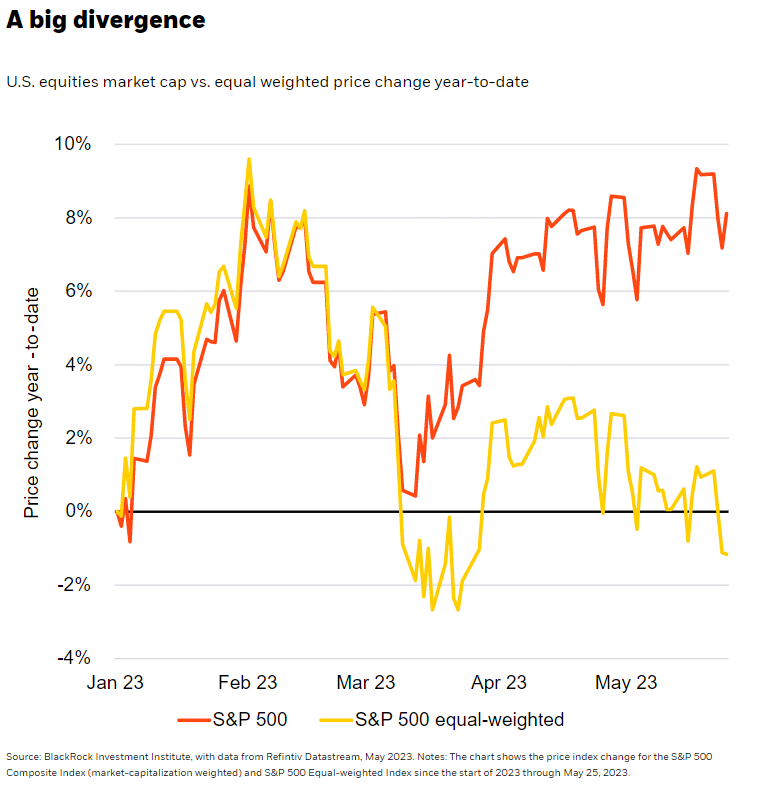

Stubbornly high inflation has prompted the Fed’s fastest rate hike campaign since the 1980s. Markets are no longer pricing in repeated Fed rate cuts, a sign they’re grasping inflation’s persistence, in our view. And the full effect of central banks’ rate hikes is kicking in. Data last week showed Germany has entered recession even with a smaller-than-feared energy shock. In the U.S., GDP has held up but it has arguably entered recession based on gross domestic income, which assesses the economy’s performance on an income rather than spending basis. A deeper look reveals stocks reflect worsening growth: The S&P 500 index was up nearly 10% so far this year (dark orange line in the chart). But a few large technology firms valued above $200 billion are driving those gains as they benefit from artificial intelligence buzz. Applying equal weighting to all companies in the index regardless of size shows it’s down over 1% this year (yellow line) – extending 2022’s hefty losses.

What’s ahead for central banks

Inflation and wage growth remain sticky, even with this deteriorating growth picture. Why? U.S. consumer spending’s shift back to services from goods caused core inflation to fall at first. Yet labor constraints persist, with unemployment still near historic lows. We think tight labor markets are keeping wage gains high, making overall inflation stubborn. April PCE inflation data out last week confirmed that. Inflation is running even hotter in Europe, especially the UK. Central banks face a clear trade-off, in our view: crush activity to ease labor constraints and curb inflation – or live with some above-target inflation.

We see the Fed nearing a pause in rate hikes and living with some inflation to avoid the deep recession needed to get inflation near its target. But we don’t see the Fed coming to the rescue of a faltering economy with rate cuts later this year due to the sharp trade-off between inflation and growth. Markets are coming around to our long-held view after having until recently priced in repeated rate cuts in 2023. We think the European Central Bank will hike more, regardless of the economic damage. The Bank of England (BOE) is in a similar position. Markets have priced in as many as four more BOE hikes. We think that might be a bit overdone, as it would be equivalent to the Fed hiking to around 7-7.5% – enough to trigger a severe recession.

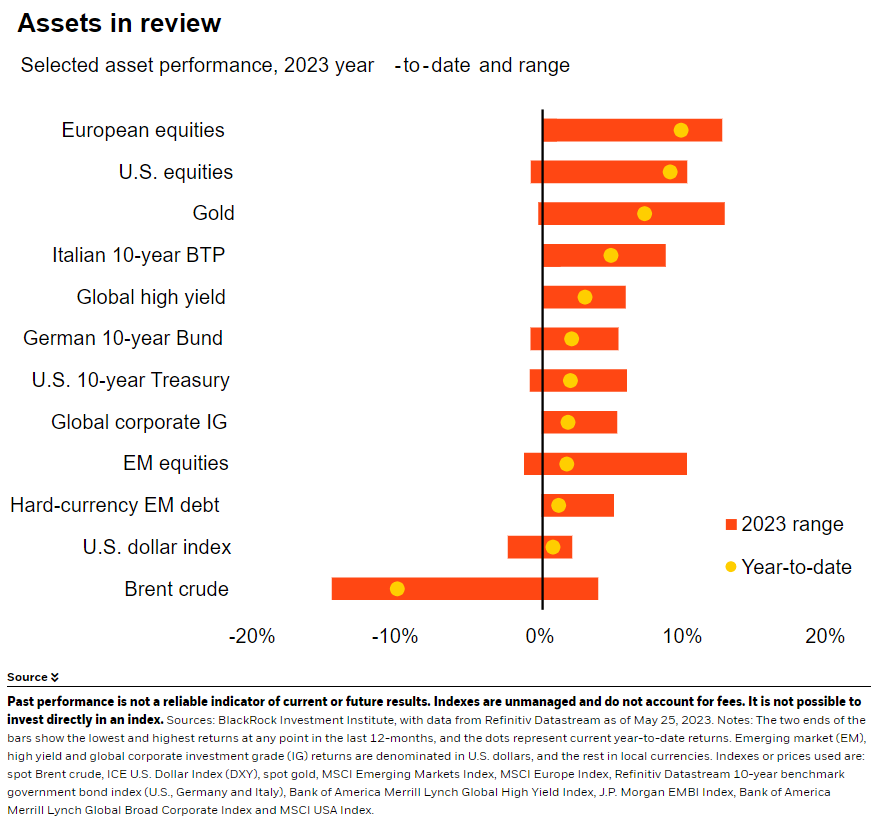

We have a relative preference for UK gilts given this outlook. We close our previous underweight on UK gilts as yields return near levels reached during last September’s turmoil. We favor quality in our portfolio. We’re neutral investment grade credit and think yields above 5% compensate for wider spreads due to any downturn. We’re overweight emerging market (EM) local currency debt given peaking EM rates and a broadly weaker U.S. dollar. We also look for quality in equities, with a preference for companies that are able to grow their earnings and wield pricing power to pass on higher costs.

Cushioning portfolios from inflation is also key. We like inflation-linked bonds as markets underestimate the persistence of U.S. inflation but better appreciate it in Europe, we think. On a strategic horizon of five years or more, we lean into real assets that can buffer inflation like infrastructure and industrial properties. Strategically, we see returns for developed market (DM) stocks above bonds’ as growth returns and inflation lingers in the U.S. DM stocks look riskier to us in the near term than fixed income given current yields. Debt ceiling concerns have upped market volatility, but we see the growth-inflation trade-off as a bigger driver of volatility longer term. We prefer EM stocks as they better price in the damage, yet China’s growth stalling would pose risks.

Our bottom line

Markets are reassessing policy rate expectations as sticky inflation makes clear central banks won’t cut them this year – or will keep hiking. We turn to high quality sources of income in the short term and stay cautious on risk assets.

Market backdrop

Major tech stocks surged further last week, leading U.S. stocks slightly higher – even as the U.S. potentially facing a technical default dominated market attention. Meanwhile, long-term Treasury yields climbed after data showed that April U.S. PCE inflation remained hot. A credit rating agency warning it could downgrade the top notch Treasuries rating if the U.S. defaults reinforces our view investors will demand more compensation for holding long-term bonds given higher policy rates.

We’re watching key inflation and labor market data in developed markets this week. We see wage pressures from a tight labor market in the U.S. and euro area keeping core inflation above policy targets for some time. We expect some easing of labor market tightness as the lagged effect of rate hikes by major central banks starts to hit economic activity.

Week Ahead

May 31: China manufacturing PMI

June 1: Euro area inflation; U.S. manufacturing PMI

June 2: U.S. payrolls

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 30th May, 2023 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.